Estate Tax Planning Carroll County, Maryland

No one wants to think about their own death. It is an uncomfortable conversation that many hope to avoid. However, estate planning isn’t for the benefit of the deceased as much as it is for the loved ones we leave behind. If your estate planning is done properly, your heirs can limit their federal and state estate tax liabilities while also decreasing the chances of a painful and costly probate process (oftentimes triggered when someone dies without a will).

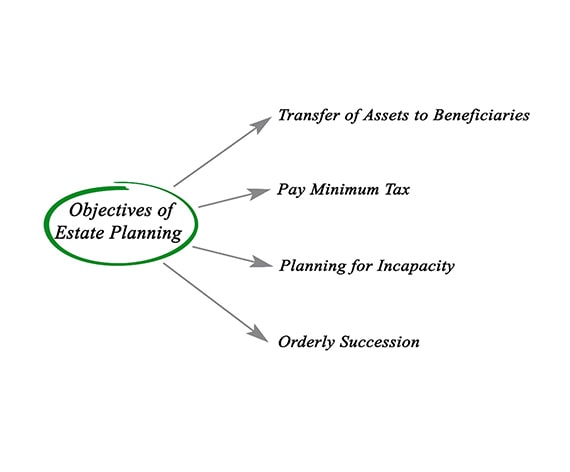

Estate tax planning Carroll County needs to differ based on an individual’s goals, wishes and their phase of life. For some, the focus may be on generating a will to stipulate where assets will go, others are more concerned with who will step in to take care of their children should they pass away unexpectedly. Another person’s priority may be to create a tax efficient plan for transferring wealth to their children. Business owners oftentimes will implement estate planning for the purpose of transferring ownership of the business in the event of their demise.

Regardless of what spawns an individual to engage in estate planning services, the overarching goal is the same: peace of mind that your loved ones will be taken care of when you are gone, and that your plans will be carried out according to your wishes. Keep in mind that as your assets grow, life events unfold and/or regulations change, the strategies employed may need to change as well.