Fundamentals of Investing

Dictionary.com defines investing as “putting money to use, by purchase or expenditure: in something offering potential profitable returns, as interest, income, or appreciation in value.” Essentially, it is putting your money into assets like stocks or bonds, with the expectation that it will grow over time. What most people search for isn’t the definition of investing, but rather the secret recipe. How do I yield the highest return? What is the winning strategy that will make me the most money? Unfortunately, there is no secret recipe or answer key privy to a select few. Investing is a dynamic process impacted and driven by various external forces such as economics, geopolitical events, psychological and financial behaviors and more. The good news is you can set yourself up for investing success through reading, understanding, and applying the fundamentals of investing.

Risk/Reward Ratio

Understanding the relationship between risk and reward is crucial in learning about the fundamentals of investing. Usually, the higher the risk, the higher the potential return. Loss of principal, lagging inflation, income shortages, expensive fees are all consequences of taking on risk. Risk varies depending on what vehicle you are invested in (stocks, bonds, mutual funds) and within each asset class. Those who are ultra-conservative and want little to zero risk tend to invest a substantial percentage in treasury bonds, certificates of deposit and T-bills. The caveat with this strategy is that when the risk is low, so is the return. The level of risk even varies among different stocks. For example, penny stocks, alternative investments such as hedge funds, and high-yield bonds (aka junk bonds) tend to be much more volatile than blue chip companies that pay annual dividends.

Bonds tends to be safer than stocks, although we saw within the past couple of years they too can deviate from their typical behavior. More often than not though, they have a low correlation level to stocks, meaning they can offset the risk that stocks bring to a portfolio. Bonds are based on a rating scale. There are three primary rating agencies that evaluate creditworthiness of bonds: Moody’s, Standard and Poor’s, and Fitch. The issuer’s financial ability to make interest payments and repay the loan in full at maturity is what determines the bond’s rating and impacts the yield the issuer must pay to attract investors. According to Standard & Poor’s scale, the top rating for an investment grade bond is AAA and the lowest rating is BBB-. Non-investment grade ranges from BB+ down to CC, and the weakest is C & D. Bonds with low ratings are considered “speculative” and referred to as “junk bonds.”

Mutual funds are managed by professional portfolio managers and have a mix of stocks and bonds within them. Within a single mutual fund, you can gain access to hundreds of stocks, bonds, or other investments. Investors who choose to invest in mutual funds want to benefit from the stock market’s historically high average annual returns but don’t want to select individual investments on their own. There are two kinds of funds: active or passive. Actively managed funds are managed by professionals who perform research and analysis to determine which funds to purchase. Passive investing is based on index funds or exchange traded funds (ETFs), which tend to carry lower fees. Mutual funds come in different structures: open-end funds and closed-end funds. You can learn more about the differences between these two options in a previous blog post.

Diversification

Diversification is a strategy used to manage risk. Placing all your money in one company, stock, industry, sector, or asset class puts your money at substantial risk. Spreading your money throughout different investments limits your risk because if one investment experiences losses, there will more than likely be others in the portfolio that don’t. Diversification can lower portfolio volatility, reduce the dependency on any one country, sector, or company, and increase risk-adjusted returns. The aim is to identify investments in segments of each asset category that may perform differently in varying market conditions. Many investors achieve this using mutual funds and exchange traded funds (ETFs). To learn the differences between mutual fund and exchange traded funds (ETFs), read a previous post. You don’t need to invest large sums of money to reap the benefits of having access to hundreds of different investment choices. You can create your preferred mix by combining stocks within different industries, sectors, and countries, and then add in bonds and perhaps some alternative asset classes. There are many strategies to choose from. Regardless of which strategy you use, diversifying is an important risk management strategy, as it can reduce the volatility of your portfolio, while not forgoing market returns.

Asset Allocation

Asset allocation spreads an investment portfolio among various asset categories such as stocks, bonds, cash, real estate, commodities, and private equity. Market conditions can cause one asset category to do well and another to perform poorly. Asset allocation is in large part determined by the investor’s tolerance for risk and the time they will be investing to achieve their stated financial goals. For example, those close to retirement tend to dial back their risk and those farther away from retirement have more time to withstand and make up for violent swings in their portfolio. Most advisors utilize a risk tolerance tool to help them gauge a client’s propensity for risk.

Rebalancing

Time has a way of changing things. Sometimes we need to adjust get back to where we need to be. This is rebalancing, defaulting back to your original asset allocation mix. Not only does this help control the level of risk in a portfolio, but it also helps to ensure the portfolio continues to align with the investor’s goals. It also allows investors to take profits from assets that have performed well and reinvest them in assets with more growth potential. There are three primary ways to balance a portfolio: altering your recurring contributions so more money is flowing to underweighted categories, selling off investments within overweighted asset categories and using those funds to purchase underweighted asset categories, and purchasing new underweighted categories. Each method should be carefully considered based on the investor’s individual circumstances, fees, and tax consequences involved. Most investors rebalance a portfolio based on a regular time interval such as every six months.

Understanding Market Behavior

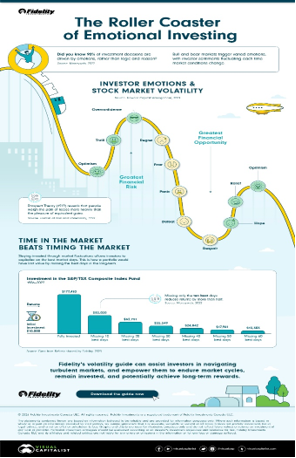

The markets are influenced by many things. A change in presidency, geopolitical concerns, a war overseas, banking system issues or failures, words spoken at a Fed meeting, a change in interest rates, and certainly the predatory media who likes to feed off world events and create havoc among the masses, oftentimes leading to market volatility and knee-jerk reactions by investors. When the reactions are negative, it can cause a deluge of selloffs across stock markets, which can be a difficult hole to climb out of. Some believe certain models can predict how the markets will react under certain conditions. Others do not, and instead try to look to short-term trends/patterns in determining buying and selling opportunities. The common denominator with either approach is the unpredictability of the markets, which can be compared to the ocean. It is unpredictable and its temperament is driven by numerous factors. It can have periods when it is calm and periods when it is wild and extremely difficult to navigate. If you intend to engage with it, the best approach is to learn as much as you can about it, understand what factors may cause it to be calm vs. volatile, recognize patterns, and make decisions based on objective information and experience.

Know Yourself (Behavioral Finance)

In understanding the fundamentals of investing, it’s essential to grasp the idea of behavioral finance. Recognizing how you view money, your financial tendencies, your fears, and your goals is crucial. Understanding the why behind your actions is important, so you can identify if decisions are being made based off the proper data and logic and practicality are being applied. The fear of missing out or FOMO oftentimes leads to speculative behavior or rash decision making. This type of investor may find themselves investing in whatever the wind blows in their direction without doing the proper research and analysis. The fear of suffering losses is another issue that can harm investors. This type of investor may move everything to cash during a significant downturn, selling on the low end and missing the upswing when the markets recover, thereby hurting their chances of making up for the losses they sustained. They are viewing their investments with a short-term rather than long-term mindset. Ask yourself these questions before making a change:

- Does my portfolio still align with my long-term financial goals?

- Does my portfolio still align with my risk tolerance I provided the advisor?

- Has my time horizon changed (when I will need to withdraw the money)?

- Do I understand what I am invested in? The risks? The objectives? Do these funds still support my goals and align with my views?

- Am I deciding to sell or buy based on sound research and analysis?

Understanding what you are invested in and why, and how those investments support your long-term financial plan will help keep you grounded. There are no guarantees in the investing realm, but you can position yourself wisely to increase your chances of financial success. Knowledge is power so understanding the fundamentals of investing is vital. Contact us today to see how we can help you. Call (410) 840-9200 or visit www.mainstadvisors.com.

Sources:

Forbes. (November 2023). What is Diversification?

https://www.forbes.com/advisor/investing/what-is-diversification/

Smart Asset. (October 2023). Different Types of Portfolio Rebalancing Strategies

https://smartasset.com/investing/portfolio-rebalancing-strategies

Investopedia. (October 2021). The 10 Riskiest Investments

https://www.investopedia.com/articles/forex/033015/10-riskiest-investments.asp

Fidelity.com. (2024). Bond Ratings

https://www.fidelity.com/learning-center/investment-products/fixed-income-bonds/bond-ratings

NerdWallet. (March 2024). How To Invest in Mutual Funds

https://www.nerdwallet.com/article/investing/how-to-invest-in-mutual-funds

Option Alpha. (September 2023). Financial Theories

https://optionalpha.com/topics/financial-theories