What You Need to Know About Tax-loss Harvesting

What is Tax-loss Harvesting?

Tax-loss harvesting is a strategy that can cut your tax bill by selling investments at a loss so you can deduct those losses on your taxes. Essentially, it is about minimizing capital gains taxes on your investment portfolio or reducing ordinary income. Who wouldn’t want to do that?

You can use tax-loss harvesting to offset capital gains that result from selling securities at a profit. You can also use tax-loss harvesting to offset up to $3,000 in non-investment income.

This strategy allows the investment portfolio to grow and compound at a faster rate since money to pay taxes is not being withdrawn from the portfolio every year that gains occurred. Tax-loss harvesting doesn’t necessarily produce any net tax savings but can be compared to getting an interest-free loan from the Federal government to use for a significant period of tax deferral.

How Does it Work?

You review your portfolio and find that your technology holdings have gone up dramatically, while your utility stocks dropped in value. You are now heavily weighted to the technology sector and need to rebalance your portfolio back to your preferred allocation by selling some of your technology stocks. As a result of doing this, you generate a substantial taxable gain. If you sell the utility stocks that declined in value, the losses generated could offset the capital gains from selling the technology stocks. This reduces your tax liability. If your losses are larger than the gains, the remaining losses can be used to offset up to $3,000 of your ordinary taxable income ($1,500 for married couples filing separately). Any losses beyond the $3,000 threshold can be carried forward into future tax years.

It is important to note that long-term losses are first applied to long-term gains, and then against short-term gains. Likewise, short-term losses are applied first to short-term gains. Long-term gains are taxed at a lower rate than short-term gains. Long-term gains are for securities held longer than one year. A maximum rate of 20% applies, but most taxpayers will pay zero in capital gains tax or a 15% rate. Short-term gains are for securities you’ve held for one year or less, and these are taxed at higher ordinary income tax rates.

Say you invested $2,000 in Fund A and $2,000 in Fund B a couple of years ago. Fund A is now worth $2,500 and Fund B is worth $1,500. You would have a capital gain of $500 on Fund A and a capital loss of $500 on Fund B when you sell. The gain and loss would offset each other, so no tax would be owed.

Now, let’s say you invested $5,000 each in Fund A and Fund B, but Fund A is valued at $6,000 now and Fund B is worth $1,000. You would have a capital gain of $1,000 and a loss of $4,000, yielding a net loss of $3,000. There would be no tax on the gain and your taxable income could be reduced by $3,000.

The Benefits Explained

Tax-loss harvesting helps investors minimize what they pay in capital gains taxes by offsetting the amount they have to claim as income. As mentioned above, it allows portfolios to grow and compound at a faster rate. Tax -loss harvesting’s economic value of tax deferral has given this strategy its fame.

Schwab provides an illustrative example of the potential benefits of tax loss harvesting in their article.

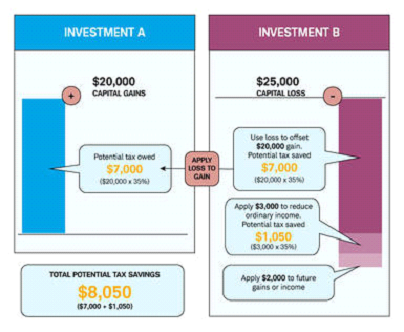

The facts:

- You recognize a gain of $20,000 on a stock you bought less than a year ago (Investment A).

- You held Investment A for less than a year, so the gain is treated as a short-term capital gain, which will be taxed at the higher ordinary income rates.

- You also sell shares of a second stock for a short-term capital loss of $25,000 (Investment B).

- Your $25,000 loss offsets the full $20,000 gain, so you would owe no taxes on the gain and the remaining $5,000 loss could be used to offset $3,000 of your ordinary income.

- The leftover $2,000 could be carried forward to offset income in future tax years.

- At a 35% marginal tax rate, the tax benefit of harvesting those losses could be as much as $8,050.

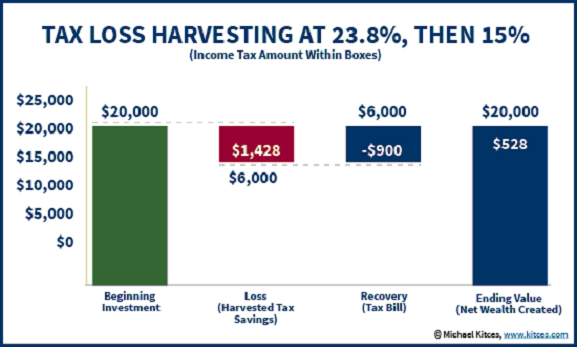

Michael Kitces does a great job of modeling the benefits of tax-loss harvesting in one of his articles. He shows how additional wealth beyond the pure tax deferral benefits is created by the difference between current and future tax rates (tax rate while working, for example, and tax rate when retired). “With a $6,000 loss, the tax savings at 23.8% would be $1,428, while the subsequent $6,000 recovery gain would only be taxed at a 15% rate for $900 of subsequent taxes. As a result, harvesting the tax loss now (at 23.8%) and repaying it in the future (at 15%) creates $1,428 – $900 = $528 of “free” wealth, simply by effectively timing the tax rates!” (Rates used based on prevailing rates at the time of article, which was 2014).

Points to Consider:

- Only apply to taxable investment accounts. Tax-deferred retirement accounts like IRAs and 401(k)s grow deferred, so they aren’t subject to capital gains taxes.

- There are restrictions on using specific types of losses to offset certain gains. If there are surplus losses in one category, these can be applied towards either type of gain.

- The wash-sale rule was created by the IRS to prevent taxpayers from creating tax losses using investments. A loss on a sale will not be allowed if the same or identical security is purchased within 30 days of the transaction that resulted in the loss. (30 days before or after the sale). To sidestep this, you can buy it back after 31 days or buy a similar (but not identical) investment to the one that you sold.

The clear takeaway is simple: tax loss harvesting yields economic benefit. This benefit is created by the economic value of tax deferral, which can lead to substantial economic benefits over time.

Sources:

Moneyunder30. (January 2021). How to Profit from Losing Investments with Tax loss Harvesting. https://www.moneyunder30.com/profit-from-tax-loss-harvesting

The Balance. (September 2020). What is Tax-Loss Harvesting? https://www.thebalance.com/tax-loss-harvesting-2466541

Kitces. (December 2014). Evaluating the Tax Deferral and Tax Bracket Arbitrage Benefits of Tax Loss Harvesting. https://www.kitces.com/blog/evaluating-the-tax-deferral-and-tax-bracket-arbitrage-benefits-of-tax-loss-harvesting/#:~:text=For%20instance%2C%20if%20an%20investment,term%20capital%20gains%20tax%20rate.

Main Street Advisors, LLC. February 2021. Main Street Advisors, Inc. is a Registered Investment Advisor. The articles and opinions expressed in this material were gathered from a variety of sources, but are reviewed by Main Street Advisors, LLC, prior to its dissemination. All sources are believed to be reliable but do not constitute specific investment advice. The views expressed are those of the firm as of February 2021 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice. Any advice given is general in nature and investors must consider their own individual situation. Always contact your financial/investment professional before making any financial decisions. Main Street Advisors, LLC is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.